D.C. Memo: BIA Says Retrans Revenue to Stay Flat Through 2028

◾ T-Mobile Added 406,000 FWA Subs in Q2 ◾ WISPA Pleased BEAD Looking to Fund Wireless Projects ◾ CCIA Tries to Stop Texas Social Media Law ◾ SHLB Floats Pole Cost Compromise Adopted in Canada

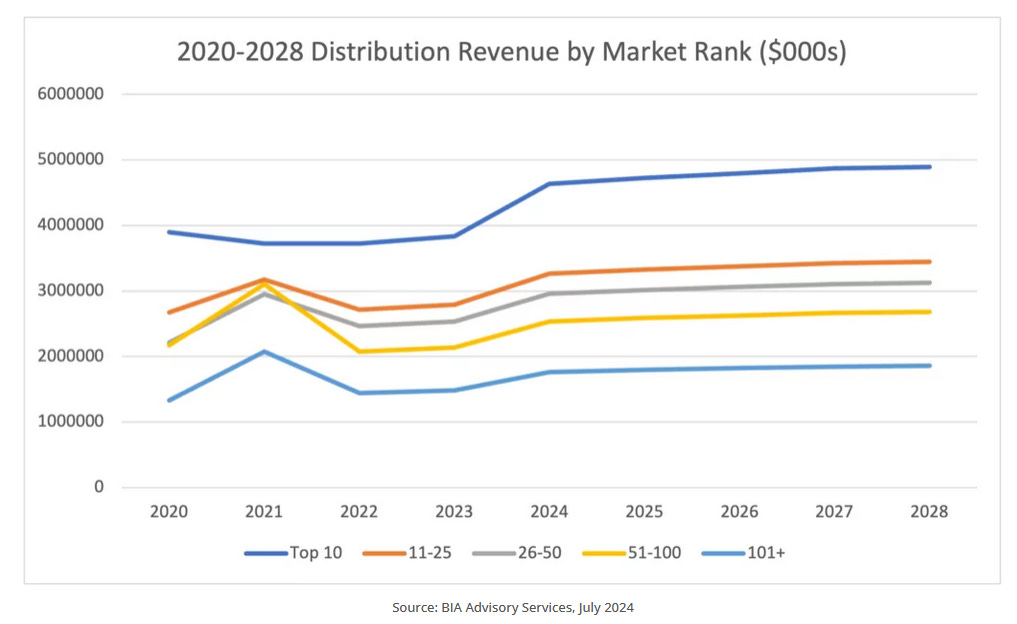

Retrans: No growth. That's the word from BIA Advisory Services in a report yesterday looking at projected retransmission consent revenue from 2024 to 2028 for TV station owners in the top 25 markets, where more than half of all retrans dollars come from. "BIA’s latest forecast for local TV station vMVPD/MVPD distribution revenue shows growth from 2023 but an overall flattening in the 2024-2028 period," BIA’s Rick Ducey said. Retrans revenue surged from $12.3 billion in 2020 to $15.1 billion by 2023. But going forward, the growth curve will go away, according to Ducey. "In a world with growing segments of homes that are cord-cutters and cord nevers with a transition to CTV/OTT streaming video services, the economics of retransmission consent are changing as MVPDs see video subscriber losses along with the associated revenues from which distribution fees can be paid," BIA’s Ducey said. The BIA report can't be good for TV station stocks because retrans revenue has become stations' chief source of revenue, overtaking advertising in recent years. As Nexstar Media Group CEO Perry Sook has said repeatedly, the FCC under the Biden administration won't permit M&A to allow TV stations to rationalize their business to stand a chance against Big Tech, prompting Republican FCC Commissioner Brendan Carr to call it "a break glass moment for America’s broadcasters." BIA’s Ducey noted that the Big Four networks negotiated retrans with streamers YouTube TV and Hulu + Live TV on behalf of their 600 local affiliates, "with networks getting more than half of this revenue."