D.C. Memo: Can Elon Musk Gain a Global Starlink Monopoly? Likely Not, Says Analyst Moffett

▪️Carr to Reverse Biden's 'Unlawful' Wi-Fi Orders▪️New C-SPAN CEO Gains YouTube TV Deal▪️Sook: FCC Moving Quickly on Dereg▪️Shentel CEO: BEAD Projects Will Lag ▪️Newsmax Files Antitrust Suit v. Fox

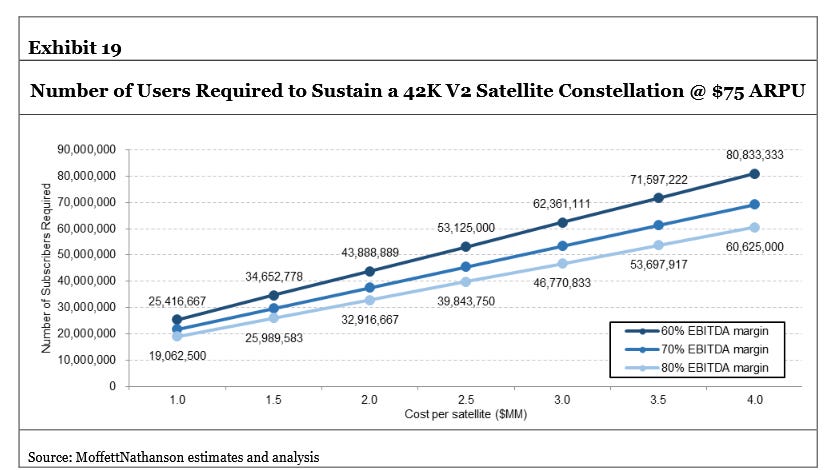

LEOs: Elon Musk has a shot at monopolizing satellite broadband, but such an outcome is unlikely based on steep economic and political challenges. Craig Moffett, senior managing director at MoffettNathanson, said the low-Earth orbit (LEO) satellite broadband sector has the hallmarks of a natural monopoly, though the market is unlikely to play out that way. “Geopolitics argue for a different outcome, however. Irrespective of the underlying economics, there will be multiple operators. And that, in turn, means lower returns. For everyone,” Moffett said yesterday in a deep-dive look at the global LEO sector led by Elon Musk’s Starlink, a division of his SpaceX rocket company. “To be sure, that alone doesn’t mean that building and operating a satellite constellation like SpaceX’s Starlink can’t be a good business. But it certainly makes it more difficult.” In one forecast, Moffett said Starlink would need about 80 million subscribers globally to sustain the operations of a 42,000-LEO constellation. Starlink today serves more than 7 million subscribers across approximately 150 countries and territories. Starlink has 8,344 operational LEOs today, according to Jonathan’s Space Report statistics kept by British-American astronomer and astrophysicist Jonathan McDowell. “To earn a return on the stupendous upfront and maintenance costs of a LEO satellite constellation, a LEO constellation needs to serve a huge customer base. Inherent capacity limitations, not just based on constellation size but also on limits of clustering within a given spot beam, make that challenging. That there will be multiple operators vying for the same opportunity makes it worse,” Moffett said. (More after paywall.)